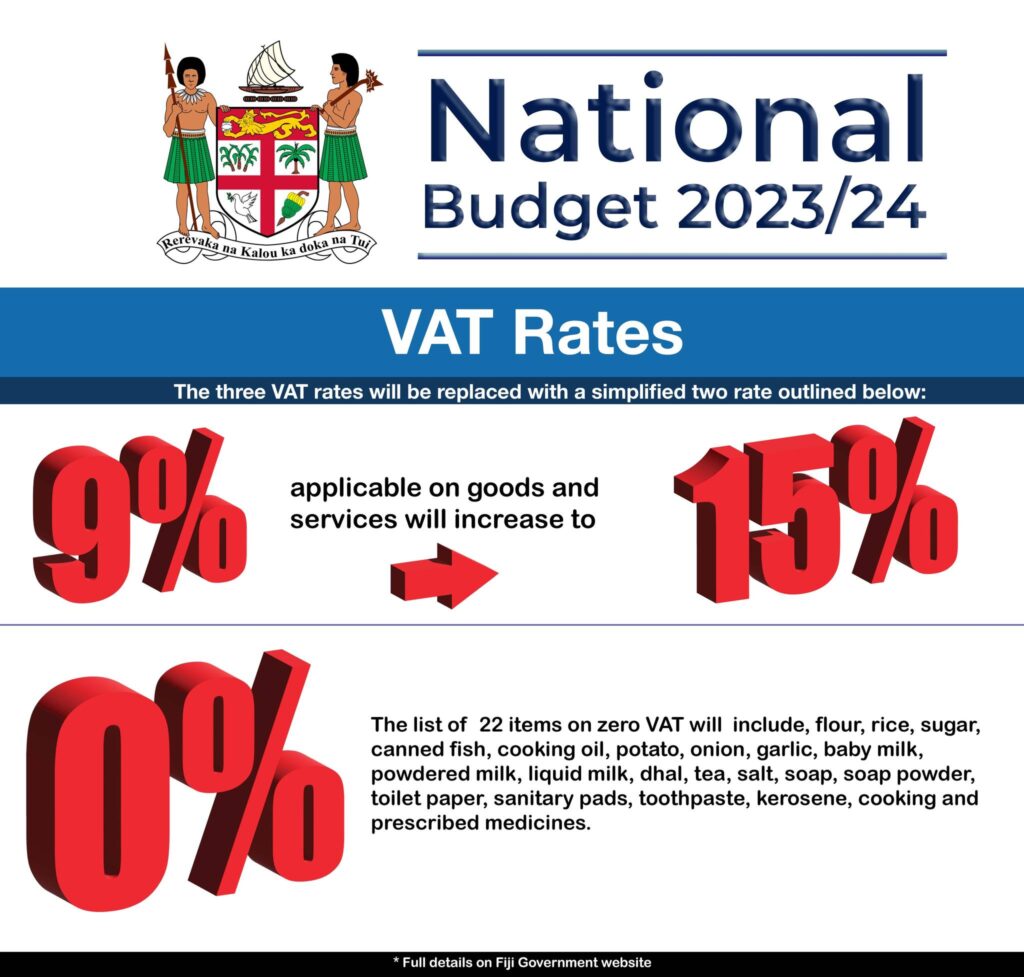

Effective from 1 August 2023 we will only have 2 rates of VAT.

The 21 items on zero VAT will continue. The government has added prescribed medicines to the list to make it 22 items.

So now the items on zero VAT will include, flour, rice, sugar, canned fish, cooking oil, potato, onion, garlic, baby milk, powdered milk, liquid milk, dhal, tea, salt, soap, soap powder, toilet paper, sanitary pads, toothpaste, kerosene, cooking, and prescribed medicines.

The supply of all other goods and services, effective from 1 August 2023 will attract a VAT rate of

15 percent. 15% VAT isn’t new. It was payable on all goods and services between 2011-2015 except on six (6) 26 basic food items it was zero.

Therefore 15% is not a new measure. These measures will generate additional net VAT collections

estimated at about $446 million for Government. But this restructuring will make the VAT system simpler to administer, eliminate ambiguity and improve VAT compliance.

To assist households with this, Government will reduce fiscal duty from 32 percent to 15 percent

on canned mackerel (except canned tuna), corned mutton, corned beef and beef products, canned tomatoes, prawns, and duck meat. Fiscal duty on sheep/lamb meats will be reduced to zero. For beef meat, the duty is reduced from 32%to 15%.

Government will also reduce import excise on chicken portions such as wings, drumsticks, legs, feet, thighs, etc from 15 percent to 0 percent.

The reduction of duties will provide ordinary households with a range of choices